How to Avoid the Holiday shopping hangover!

Let the guilt go. By avoiding that credit card bill will only make the problem worse. You need to tackle that bill and make a plan right now, not later. Remember that the reason you have the huge bill is because you were trying to be an awesome mom, dad or Grandparent and that isn’t something to feel bad about.

Make payments over a few months. The average Canadian expects to spend around $900 around the holidays, so essentially you could make $300 payments for three months and not get sucked up into the credit card debt cyclone.

Save more money and apply it to your debt. Make a ton of baby cuts to our budget to create a snowball effect. Take lunch to work three out of five days in the week – savings $120

month. Drink office coffee three days a week – savings $48 month. Have a homemade pizza and Netflix night instead of going out once a week – savings $200+ month.

Make more money and apply it to your debt. There are tons of ways to make more money and most of them are probably in your basement. Take a trip down there and look around for ways to make money that you have been missing for all of these years.

Auto-save for next year. Now that you’ve tackled this year’s credit card debt let’s start saving so that you can be a super human next year WITHOUT the guilt this time. Figure out how much you spent this year – let’s say $900 like the national average and divide it by your paychecks. So, if you get paid every two weeks that’ll be $35 every two weeks or $38 if you get paid twice a month.

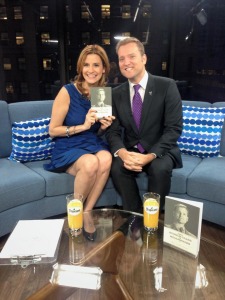

You get these holiday saving tips and more money strategies in my book From Middle Class to Millionaire at Indigo!

Dave