DCL Capital Portfolios

After years of trying every type of investing strategy, I’ve found an investment strategy that works for me and I believe for you too. I’ve tried buying Calls and Put Options, Day Trading, Futures Trading, Currency Trading, right up to Soy Bean Trading! Here is a section talking about how I’ve settled on dividend and option income investing. If you are interested in learning how you can invest this way too, contact me at davidlester@dclcapital.com.

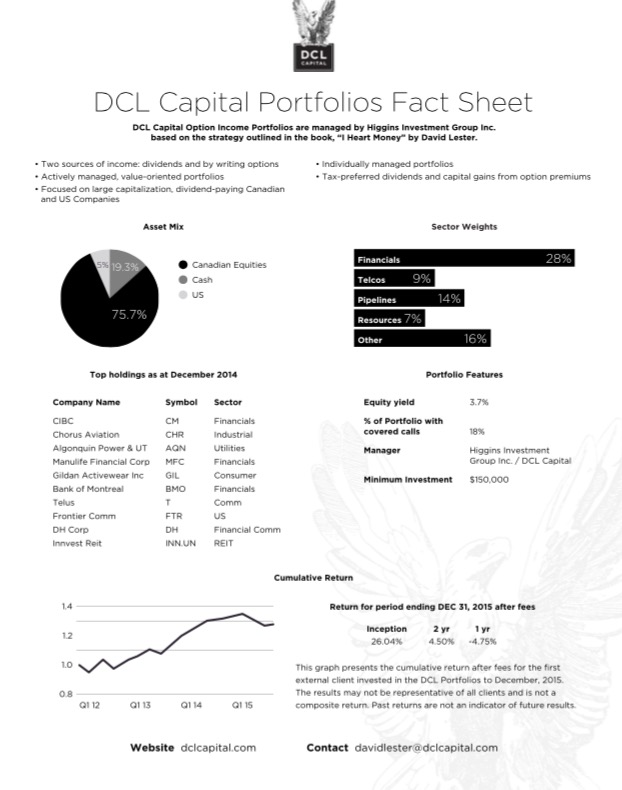

I describe this investing strategy as collecting rent in my book “I Heart Money”. I view the dividend income as the first rent and the option premiums as the second rent. In markets like we are having, and will continue to have, investors need to get paid to hold stocks with dividends AND options.

Benefits of Option Income Portfolios:

• 2 sources of income: dividends and by writing options

• Actively managed value-oriented portfolios

• Focused on large capitalization dividend paying Canadian and US companies

• Individually managed portfolios

• Tax preferred dividends and capital gains from option premiums

This strategy is the only way that I invest now and I can help you too,

Dave

The DCL Capital Income Portfolio is managed by Higgins Investment Group

About Gordon Higgins B.Comm, C.A., M.B.A, C.F.A, DMS: Mr. Higgins was the Vice-President, Equities of mutual fund and closed end fund manager Sentry Select. Mr. Higgins was Vice-President, North American Equities at Howson Tattersall/Lancet Asset Management and, prior to that, was Vice-President, Canadian Equities of Elliott & Page/Manulife Insurance. He graduated from the University of Toronto with a Bachelor of Commerce degree and received his Masters in Business Administration from York University, Schulich school of business. Mr. Higgins holds both the Chartered Accountant and Chartered Financial Analyst designations. He is now President of Higgins Investment Group.